Business Texting for Financial Services: Text The Merchant, Close The Deal

This article originally appeared in deBanked’s Mar/Apr 2017 magazine issue and on deBanked’s blog April 14, 2017.

Ted Guggenheim, co-Founder of TextUs, spoke with Ed McKinley of deBanked Magazine. deBanked serves as a news source for those wanting to keep up with the crossroads of the financial industry and the online world of financing.

In layman’s terms, they help “merchants” (wholesalers or retailers who have expertise on the goods they’re distributing), stay informed on the financial dealings of others like them, and the ways that the online business/financial world is growing and changing.

deBanked wanted to put together a piece on the way that texting as a form of business communication is shaping how companies work today, and Ted was a natural choice for giving a little insight into how texting for business came to be so effective and successful.

What did deBanked learn from TextUs co-founder, Ted Guggenheim?

Long-code vs. Short-code Texting

The question on the minds of many is, how can businesses contact customers, or prospective customers, in a way that is fair and legal? Ted Guggenheim has the answers:

“If you’re (randomly) contacting people you got off a list somewhere, that’s a pretty bad idea,” said Ted, referring to the fact that the best way to send groups of messages in an attempt to target the interested parties, is to get permission from those recipients in advance.

Ted explained that the reason behind this, is that federal agencies regulate five-digit short-code texts pretty heavily, but are much lighter on long-code texts, those being sent from 10-digit numbers. If someone were to call back the number they received the message from, were it a 10-digit number, someone would answer that call.

Opt-in Guidelines from the CTIA

Citing guidelines from the Cellular Telecommunications Industry Association (CTIA), Guggenheim stipulates that consumers should have the ability to opt out of additional messages after receiving the first one.

Members of the industry who want to send groups of text messages can post conditions on their websites that compel users to grant permission to contact them by text if they submit their contact information, he suggests.

Keep Messages Conceptual Rather than Marketing-Oriented

Keep messages conceptual rather than marketing-oriented, Guggenheim advises. Messages should directly address the customer’s situation to avoid seeming they were sent by a robot, he says. As with any response a salesperson receives, getting back to customers quickly pays off in better results, he adds.

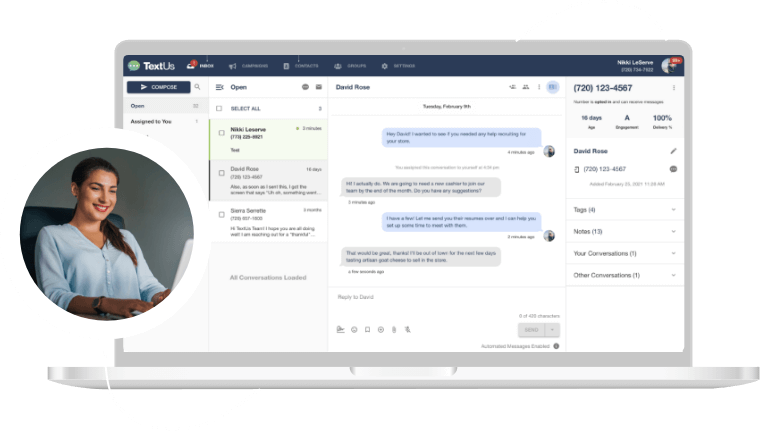

When sending a batch of texts, vendors of the bulk service can ensure every text bears the same phone number that the sales rep uses to call the client, thus avoiding the possible confusion of using more than one number, says Guggenheim.

The system he offers can trigger a pop-up on the computer screen of a specified salesperson when a text recipient responds, he says. It also keeps management informed of the volume of texts and the response rate, he says. That helps managers determine which types of text messages are working, he maintains.

A few other key takeaways for business texting in financial services

Texting for Business: How Does it Start?

“I just got the idea to send a text,” said Cheryl Tibbs, general manager of Douglasville, Ga.-based One Stop Funding. Tibbs was helping out a client who is a lawn care provider, and knew that needed a way to get ahold of him fast. Because of the nature of his work, phone calls were out of the question, and an email could take a day or two to hear back on. She chose to shoot him a quick text to inform him that he needed to take just a few more steps to push his funding process forward so that he could receive the loan he needed, and she heard back just minutes later.

After this first successful texting exchange, the two realized just how convenient texting was for them, and they kept it up: “He’s been a customer for us for a while, and that’s just how we communicate,” she says. “It’s easy for him to stop and shoot me a text as opposed to having a full conversation with me.”

Why Do Businesses Love Texting?

Once businesses try texting as an alternative, it’s hard for them to go back. Because of the heightened number of responses, and the speed at which these responses come in, the demand for the ability to handle business dealings via text has skyrocketed. And as deBanked has shown, the alternative small-business funding business is no exception: “Text messaging is more powerful than emailing nowadays,” says Gil Zapata, CEO of Miami-based Lendinero.

Merchants and Texting

What do we know about why merchants respond so well to business texting as a medium? According to Tibbs: “It’s a matter of convenience for the merchant. In this business, any way you can make it easier for the merchant to facilitate the transaction with you is the method you have to use.”

Not only is texting the most convenient way to contact people, but according to Jeb Blount, author of eight books on the topics of sales and sales strategy, a text carries with it a more effective sense of urgency than a call or email can. “When you send a text message you move to the top of a person’s priority list,” he says. He also notes that even during conversations in person, one party may disengage momentarily to check or reply to a text message. “It’s treated as something that’s urgent.”

Who is Already Having Success, and How Are They Using Texting?

So, what is it that these businesspeople are utilizing texting for?

“I use them as another tool for follow-up communications,” says John Tucker, managing member of 1st Capital Loans in Troy, Mich. “In addition to sending them an email, I’ll shoot them a text.”

Even in addition to calls and email, texting can be a great way to give yourself, or your contact, concrete confirmations or check-ins about deals, like financing, that are currently being processed. Scott Williams, the managing member of Florida-based Financial Advantage Group LLC, likes for his associates to first contact by phone, then send an official offer via email, and from then on, send text updates. “We can tell them, ‘Hey, everything got cleared this morning – we should be able to do the funding this afternoon,’” he says.

Clients can use messaging to convey images of documents needed in the funding process, Tibbs says. “I had a merchant yesterday who sent me over her IRS tax agreement through picture message,” Tibbs says by way of example. Often, funders request color images of both sides of an applicant’s driver’s license, she notes. To fulfill such requirements, it’s generally easier to snap a photo with a phone and send it as a picture message than to scan pages of paper into a computer to create an electronic document and then send the resulting file by email. “We do a lot with picture messaging,” she observes.

Get a TextUs Demo

Learn how thousands of businesses use TextUs everyday to communicate in real-time.